Payex Subscriptions product offers our merchants the ability to set up subscription billing flexibly and easily. Payex merchants will be able to collect payments on a scheduled basis as defined by our merchants, be it daily, weekly, monthly, quarterly or yearly. To help you visualise the mandate process and timeline, we’ve designed scenarios below with side by side comparison on Direct Debit and Auto Debit process:

| High level process for scenarios below: | Direct Debit timeline | Auto Debit timeline |

|---|---|---|

| Customer authorises mandate | Day T | Day T |

| Bank or Visa / Mastercard approves mandate | T+1 working day | Instant |

| First deduction from bank account / cards | T+2 working day | Instant |

| Transaction reflected in Payex portal | T+3 working day | Instant |

| Settlement to merchant | Instant | T+2 working days |

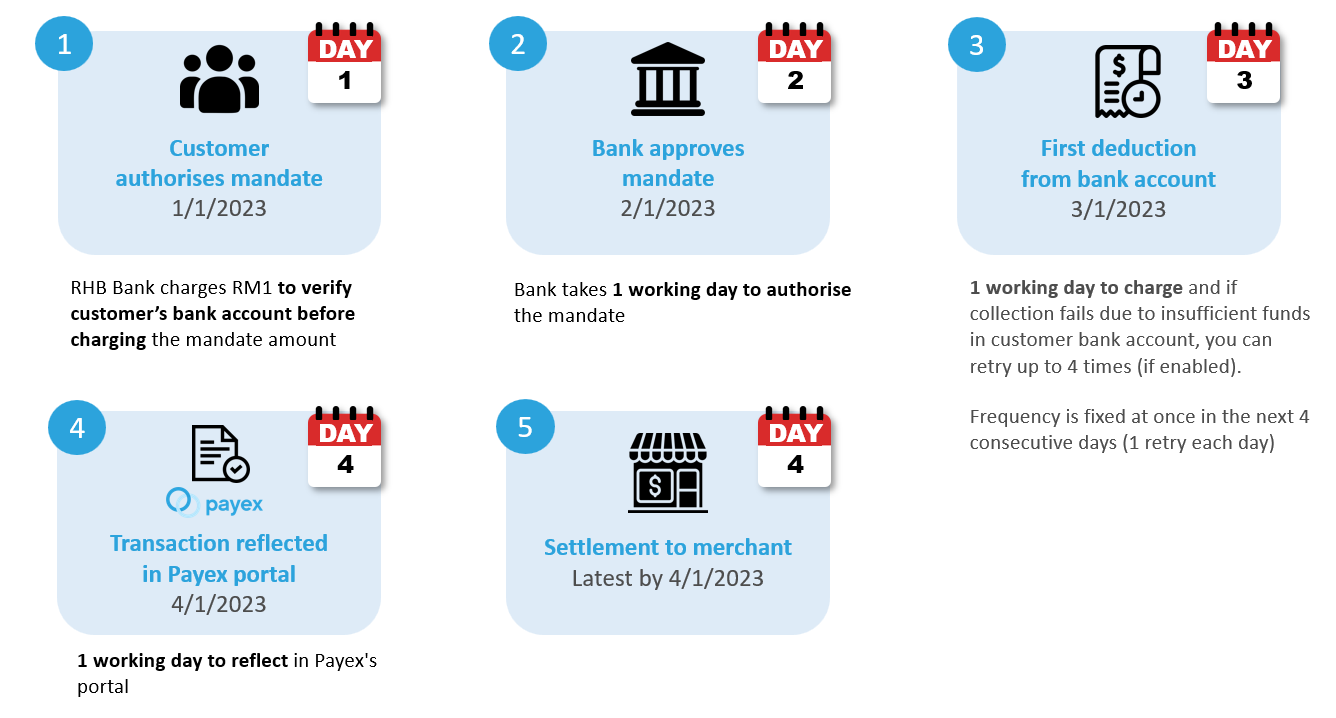

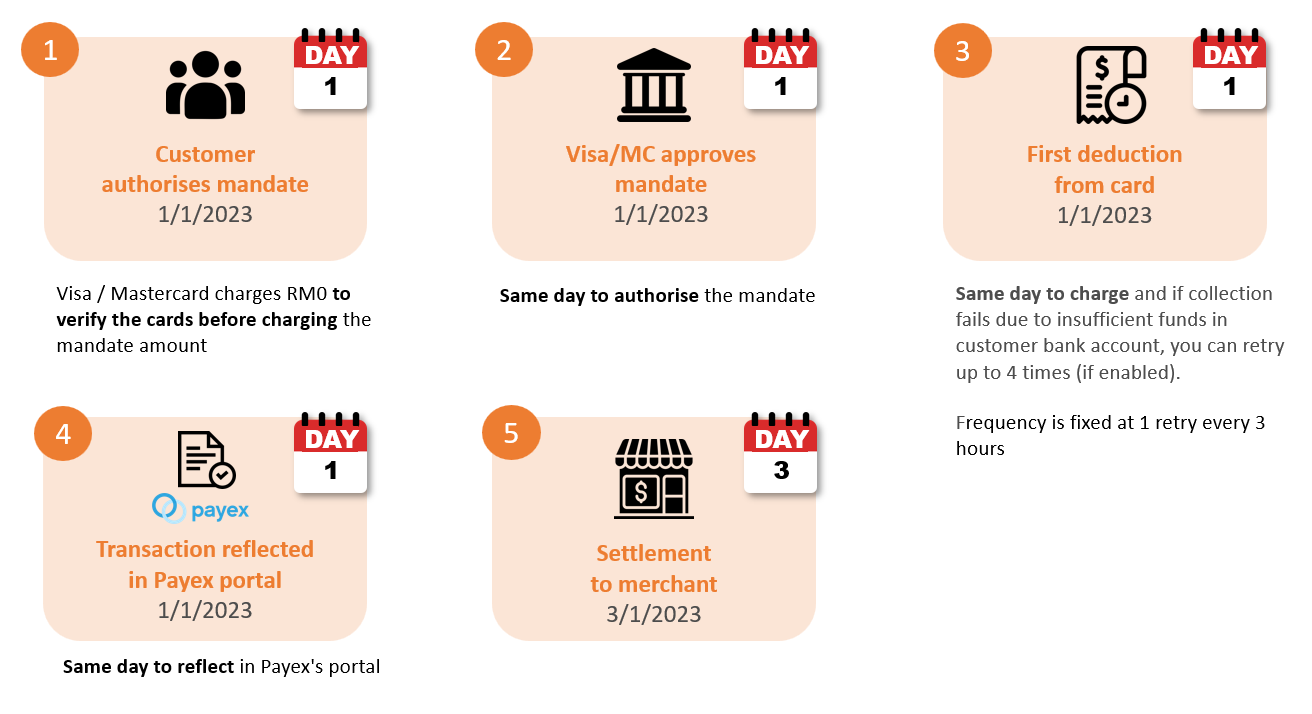

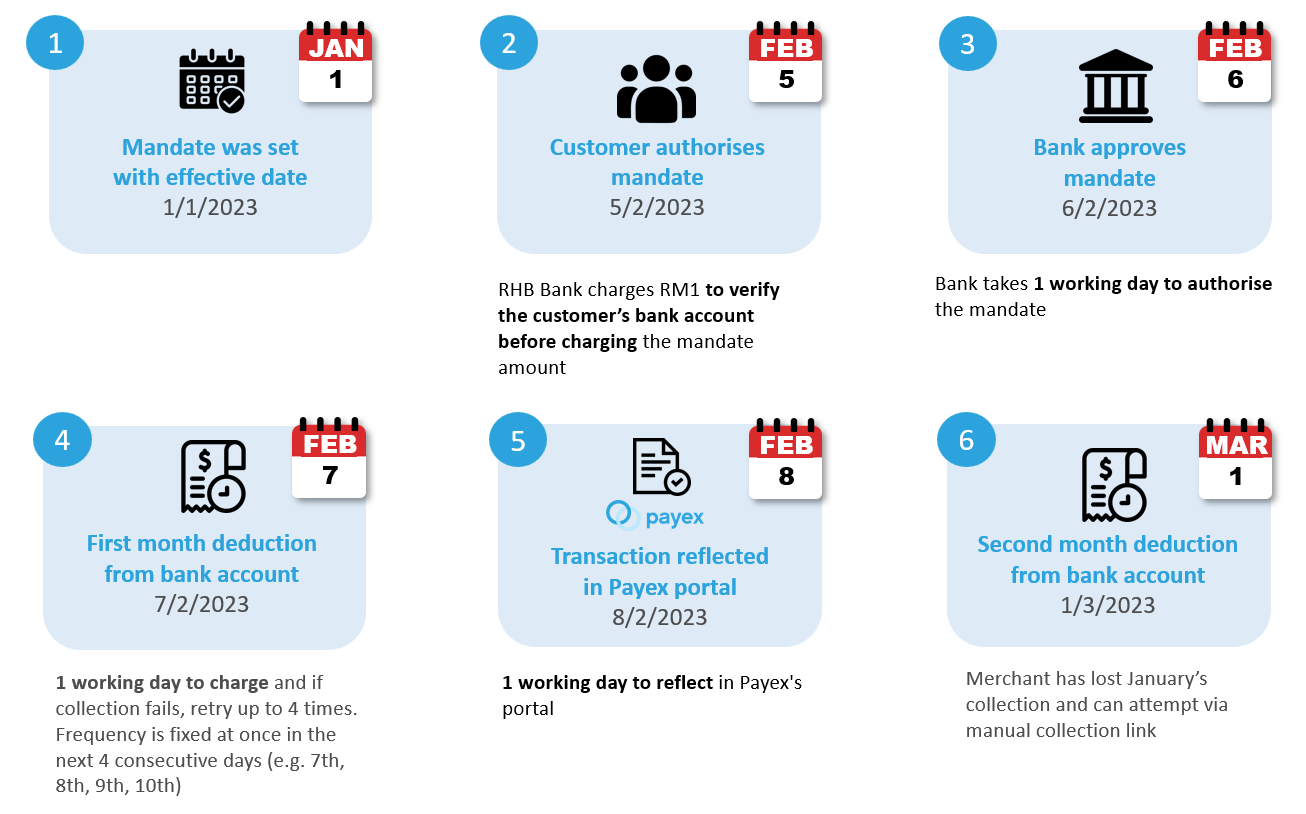

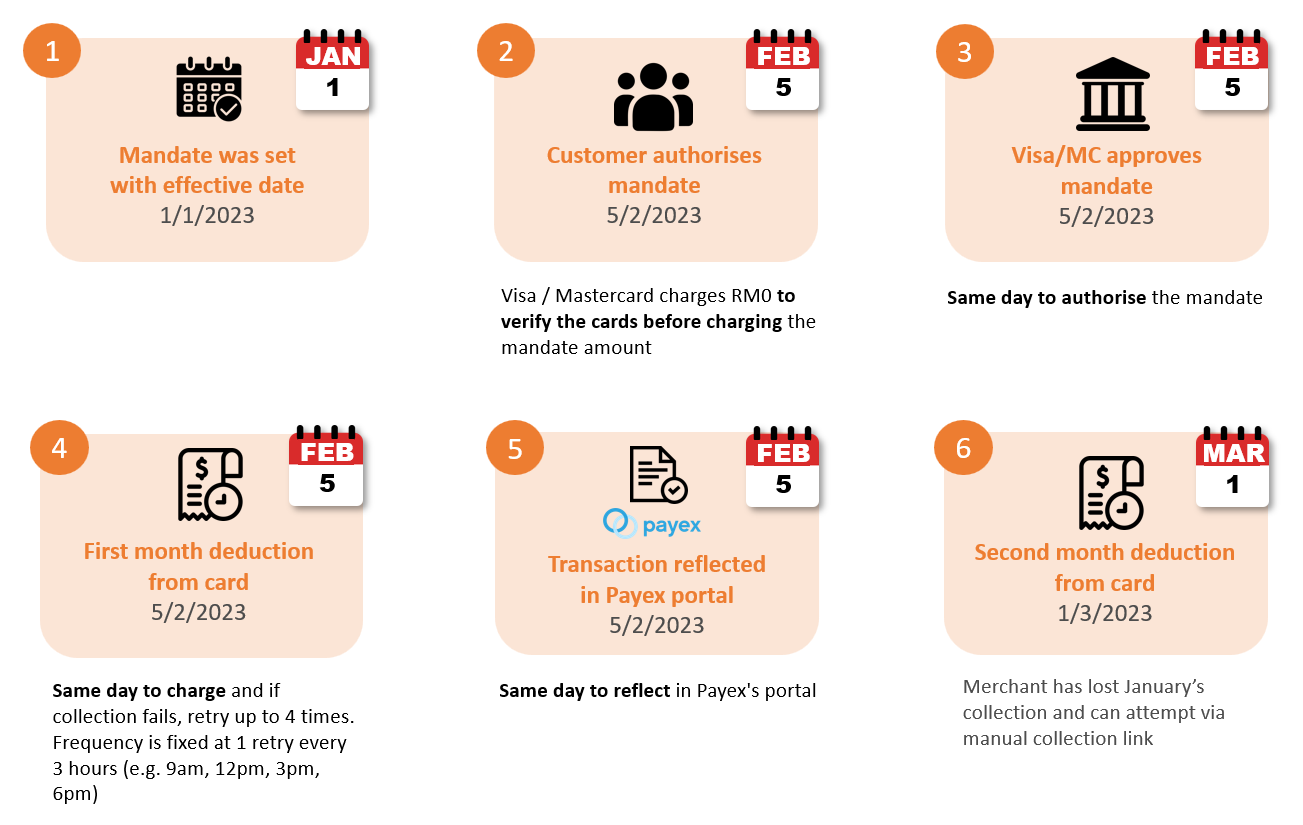

Scenario 1: If customer authorises mandate upon receiving the link #

| Direct Debit (bank account) | Auto Debit (cards) |

|---|

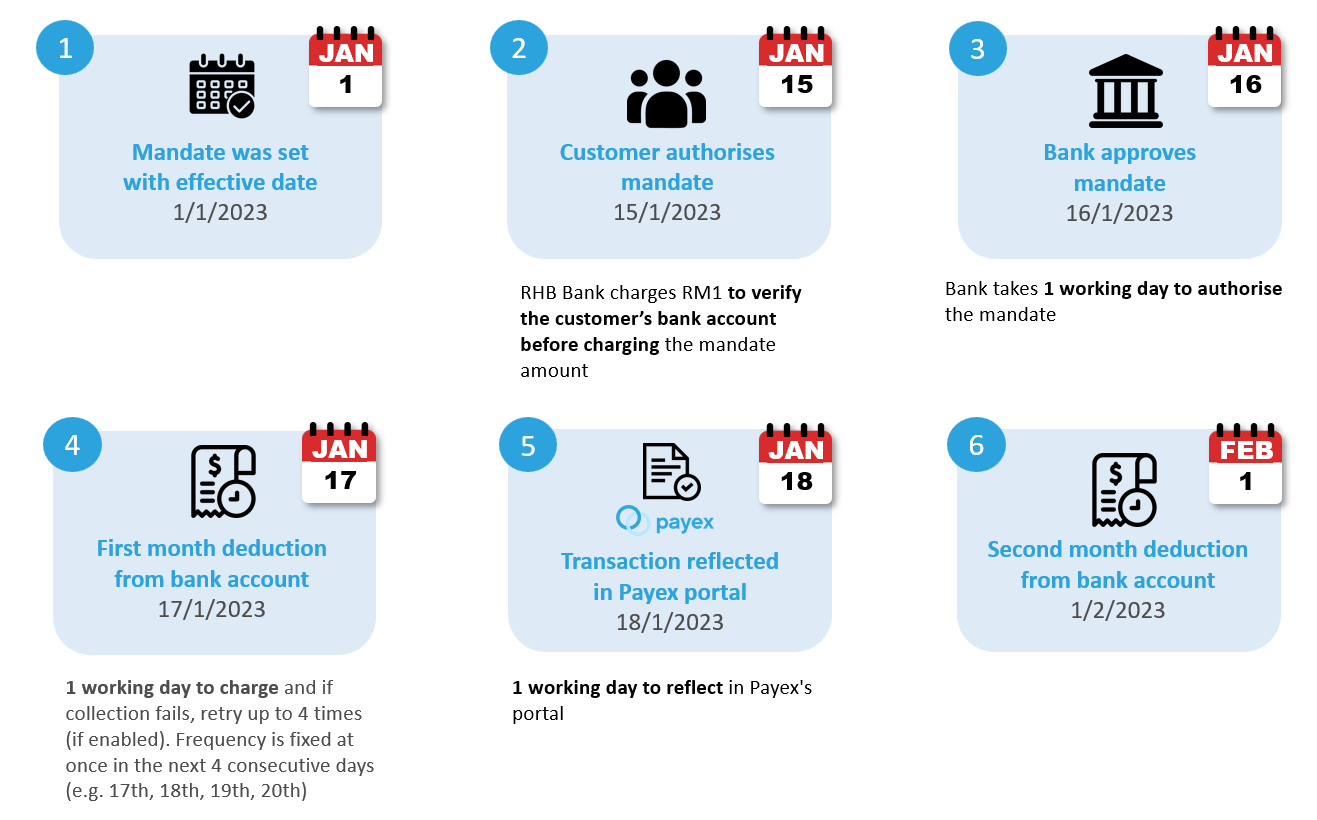

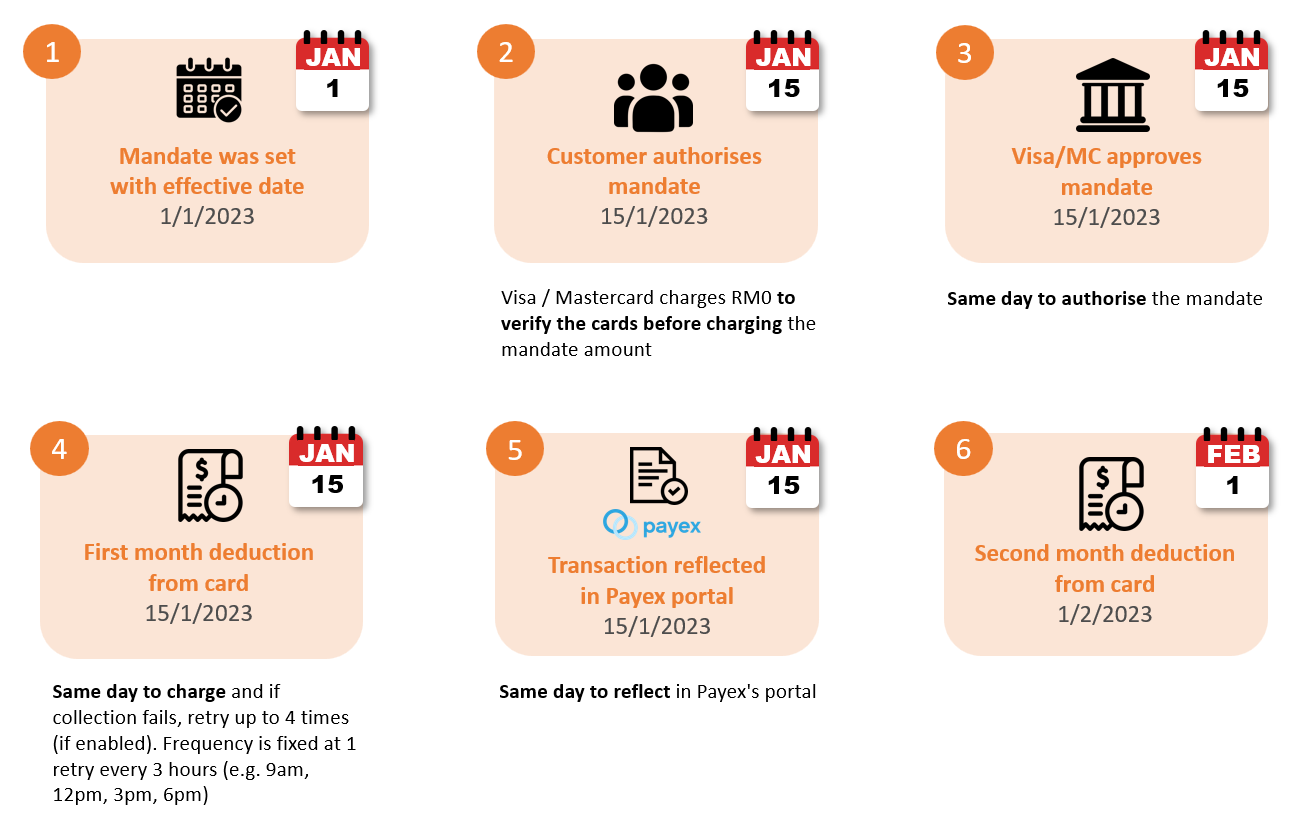

Scenario 2: If customer delays in authorising mandate (e.g. 2 weeks later) #

| Direct Debit (bank account) | Auto Debit (cards) |

|---|

Scenario 3: If customer delays in authorising mandate (e.g. more than 1 month) #

| Direct Debit (bank account) | Auto Debit (cards) |

|---|

* depending on the mode of subscription payment :

- Bank account – earliest first deduction fall on the next day after the approval by the bank

- Local / foreign card – earliest first deduction fall on the same day after the approval by the bank

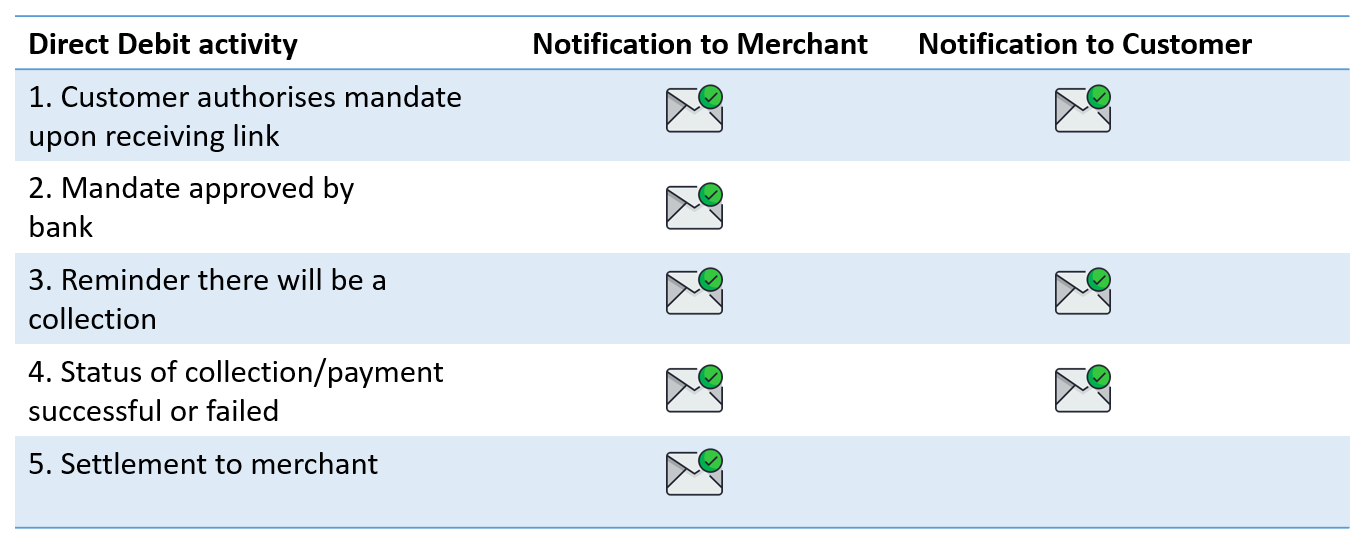

Email notification from Payex #

Direct Debit #

Note: For Direct Debit, customer will be notified via email each time Payex attempts to deduct (retry collection) from customer’s bank account.

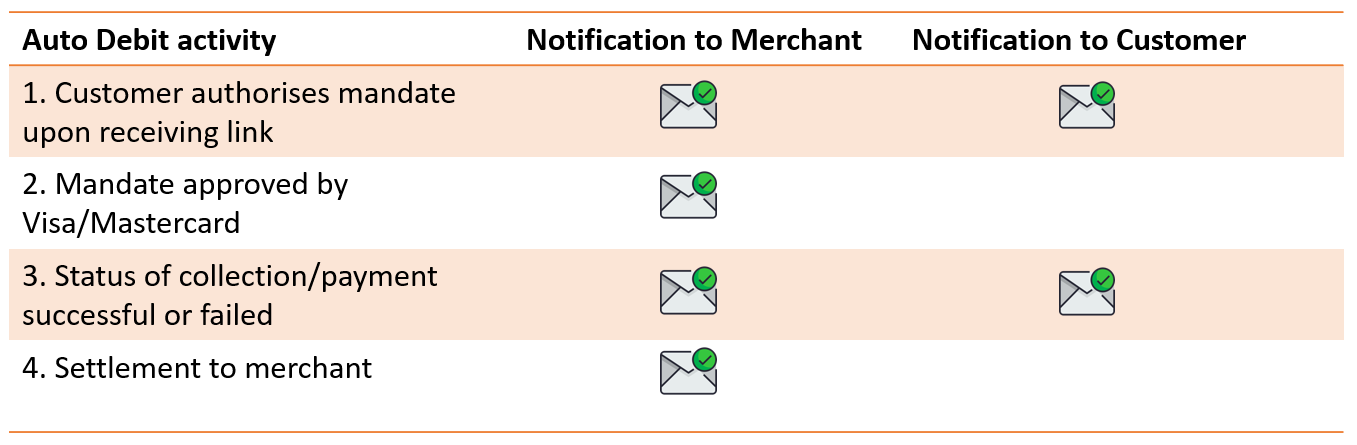

Auto Debit #

Note: There is no notification reminder when there will be a collection, as collection will happen same day as approval.

For Auto Debit, after a collection retry is attempted, Payex API includes endpoint to retry the same collections. you may also use that API endpoint to customise the notification on the retries made.