Getting Paid #

- Settlement is the process in which the money received from your customers is settled by Payex to your bank account.

- Settlements for all payments are done in RM (Malaysian Ringgit).

- Payex will deduct the fees before settlement to the merchant’s bank account.

Settlement Frequency #

- The settlement days are varied depending on the mode of payments that have been transacted.

- Our settlement cycle is T+X working days, T being the date of transaction.

- This means that the captured payments are settled within X working days from the date of transaction.

| Product | Settlement Frequency |

|---|---|

| Local credit card, local debit card, foreign card | 2 working days |

| FPX | 1 working day |

| Local eWallets (Grab Pay, Touch N Go, Shopee Pay) | 1 working day |

| Foreign eWallets (Alipay and WeChat Pay) | 2 working days |

| Subscription payment via bank account | Instant |

| Subscription payment via cards | 2 working days |

| 0% credit card instalment via Ezbeli | 7 working days for all banks |

| Multi-currency payment | 5 working days |

| 3-month instalment via Riipay | 7 working days |

| 3-month instalment via Atome | 3 working days |

| Postpaid via Grab PayLater 4-month instalment via Grab PayLater | 2 working days |

| Offline card machine | 2 working days |

Step 1: Login to Payex’s Portal #

Log on to our portal at https://portal.payex.io/Home, and key-in your credentials.

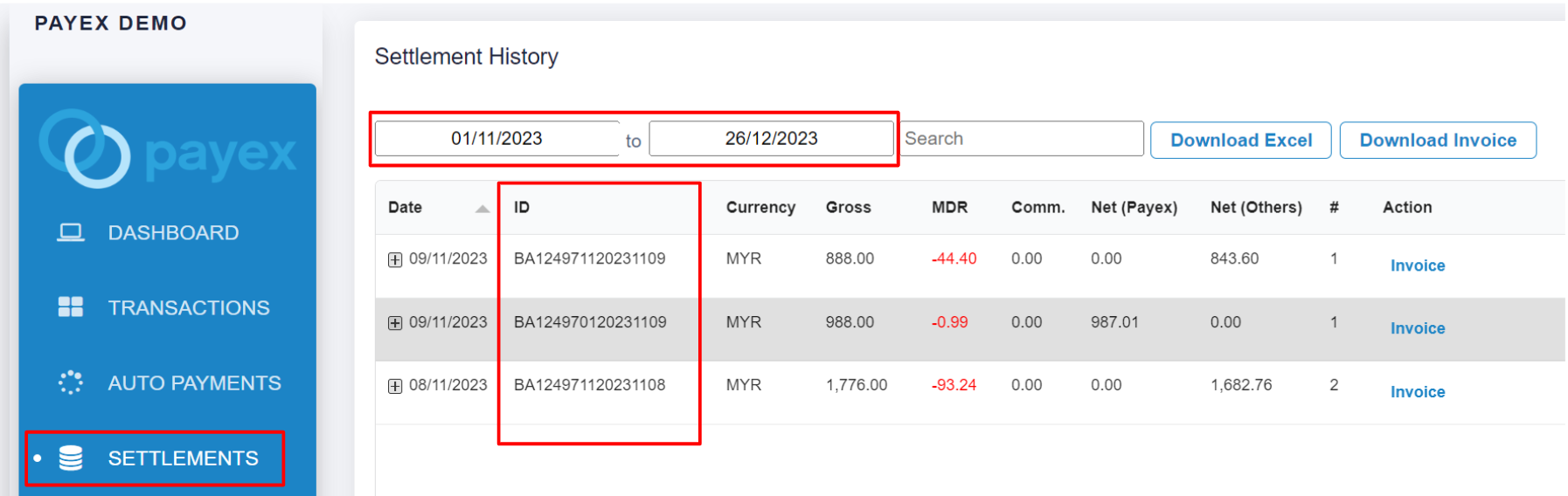

Step 2: Navigate to Settlements #

- Please note that you will not be able to locate the Settlement ID if the settlement is not due yet

- If your settlement is already due, click “Settlements” on the left panel

- Filter the due dates of your settlement (e.g. T+3 working days for Payex CIMB credit card instalment)

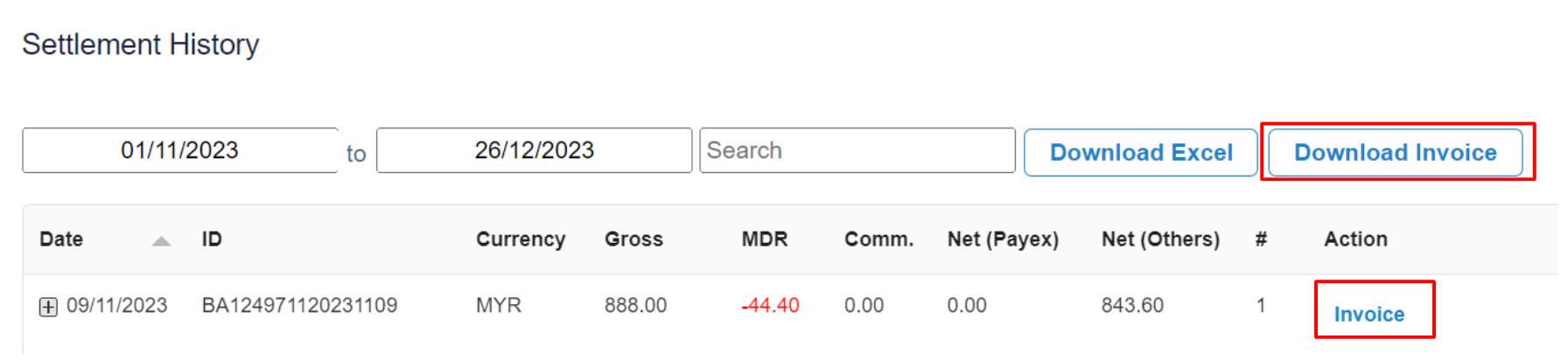

- Each settlement has a Settlement ID (e.g. BA124971120231109) and you can see this number in the ID column

Step 3: View more details of each settlement #

There are three options for this:

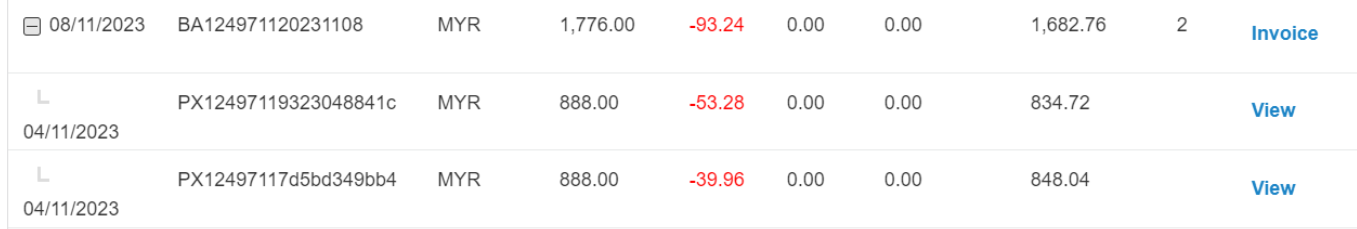

Option 1: Click the “+” button #

- As one settlement could include multiple transaction’s settlement, click the “+” button to expand the settlement row. You will get to view more details of each settlement alongside the transaction ID.

- Click “View” to navigate back to the specific transaction at the Transaction History dashboard

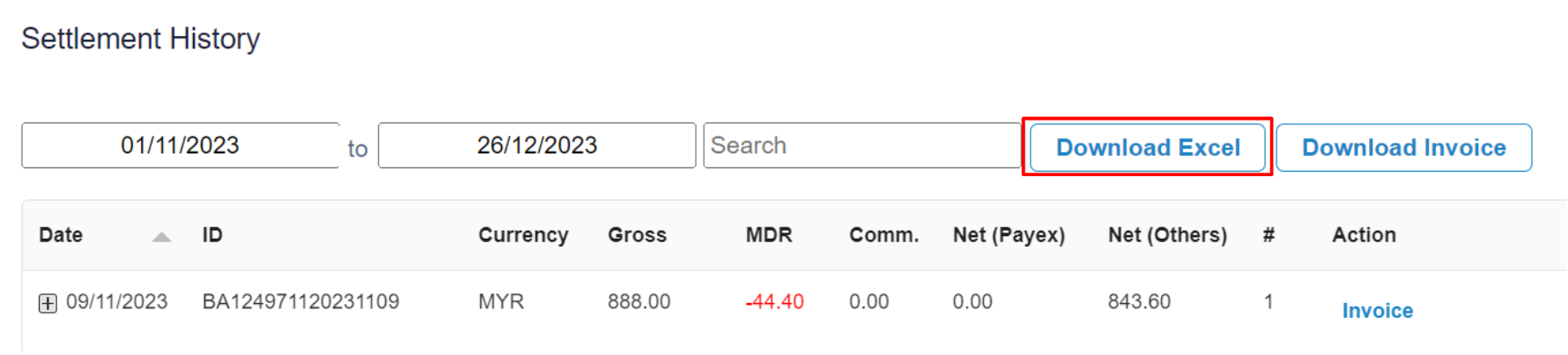

Option 2: Download Excel #

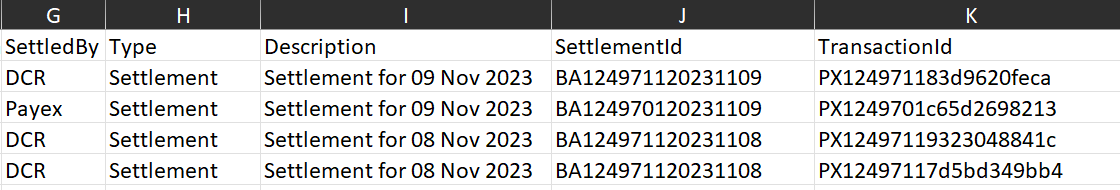

Click the “Download Excel” button to extract all settlement information into an Excel file named “Settlement“.

- You can download a daily, weekly, monthly or yearly report by filtering the date field.

- The report contains settlement amount with the corresponding Transaction IDs and Settlement IDs. Refer sample columns on settlement details from the Excel file below.

Option 3: Download Invoice #

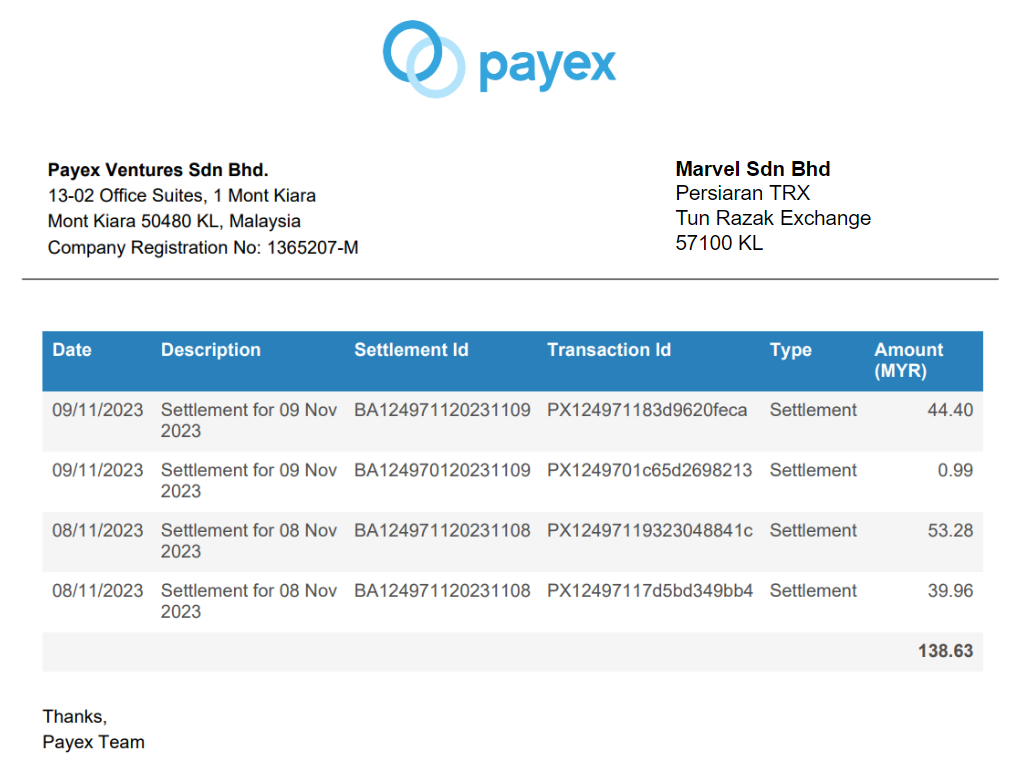

Click the “Download Invoice” button to extract all settlement expenses into an Invoice (PDF file) to track your company MDR expenses for accounting purpose.

- Click “Download Invoice” for total settlement expenses invoice (e.g. you may filter the dates by monthly settlement)

- Click “Invoice” for individual settlement expense invoice

Refer below for example of Settlement Invoice

Step 4: Reconcile Settlement with your Bank Statement #

For settlement of payments

(FPX one-time, eWallets, credit card instalment):

Refer to the Settlement ID (e.g. BA 124971120231109) found in your bank statement to identify this settlement belongs to which transaction.

For settlement of payments

(FPX direct debit via RHB Bank):

Refer to the Collection ID (e.g. CL 10000178a1c91b565e) found in your bank statement to identify this settlement belongs to which transaction.

Available Columns #

Below are the available columns in the Settlement Excel that you may refer to:

- SettlementDate

- TransactionDate

- MID (Merchant ID)

- Merchant

- SubMID

- SubMerchant

- SettledBy

- Type

- Description

- SettlementId

- TransactionId

- ReferenceNumber

- MandateReferenceNumber

- CollectionNumber

- CollectionReferenceNumber

- TxnType

- BaseCurrency

- BaseAmount

- BaseMDR

- Currency

- Gross

- MDR

- Comm

- Net

- NetPayex

- NetOthers